Out of the invoice chaos

Checklist for smart SAP e-invoicing

Corporate purchasing is facing growing challenges: rising costs, highly dynamic procurement markets and interrupted supply chains. At the same time, invoice receipt processing is one of the most important administrative processes. The human and financial resources involved are considerable. Companies are therefore saying goodbye to manual, paper-based workflows for good reason and are instead opting for electronic procurement management with SAP.

Digitization potential P2P

Those who rely on an SAP system in purchasing are already well positioned in terms of digitization. Nevertheless, there is potential for optimization. This is because the digital procurement process includes automated processing of incoming invoices in SAP. Purchase-to-pay (P2P) solutions can be integrated as SAP add-ons into the existing IT toolbox and optimize SAP purchasing processes at a decisive point. E-invoicing is oriented to the entire document flow of SAP processes. First, the incoming invoices are captured and the information extracted.

It doesn't matter whether the documents are in paper form, PDF or standardized formats. The P2P solutions scan the invoices and automatically recognize the content, which is then validated and checked. Only then do the invoices move to the central, SAP-based invoice ledger for further processing.

The high degree of automation not only saves time and effort, but also creates high data quality and transparency. Inquiries from suppliers about the processing status of an invoice can be answered with a single click. Escalation mechanisms stored in the system also remind users of discount periods, due dates and missing approvals. And finally, automatic and audit-proof archiving simplifies compliance.

Invoice Management

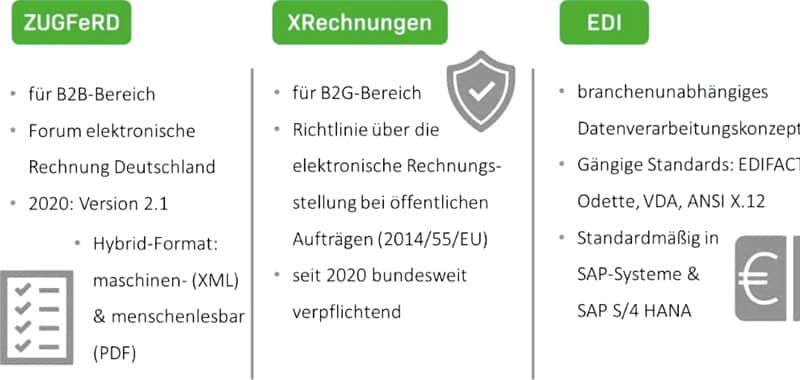

Integration with SAP is a basic requirement for such add-on solutions. However, companies should pay attention to other criteria when making their choice. The electronic capture of invoices is the basis of electronic invoice processing. The systems must be able to process and read any type of invoice - regardless of whether it is a paper invoice or an e-mail attachment. According to the Bitkom digital association, the majority of electronic invoices arrive as unstructured PDFs. This is followed by structured formats such as EDI, ZUGFeRD and XInvoices. A smart invoice management solution should support all these formats, be able to scan paper documents without errors and automatically recognize invoice content.

Matching with SAP master data

Once the invoice has been received, all important data is read out and extracted fully automatically. This includes invoice header data and invoice items. This is where the advantages of the interaction between SAP and incoming invoice processing become particularly clear. With the right add-on system, the data read out can be automatically matched with the master data in the ERP system. This significantly increases recognition accuracy and data quality. In addition, the data can be enriched with additional information - for example, purchase orders and goods receipts stored in the SAP system. This in turn simplifies the verification process for clerks.

Another important function of the solutions is the automated validation of invoice data. For example, it checks whether invoice numbers are assigned twice or whether the quantity specified on the invoice exceeds the goods receipt quantity of the shipping notification. The validation usually takes place directly within the SAP GUI. However, with the right add-on solution, the validation can alternatively be performed in advance directly on the scan client. New solutions for inbound invoice processing also offer the first approaches of AI and ML. The systems learn in the background during both extraction and validation and automatically apply the trained knowledge to the next invoices.

Archiving compliance

Companies must comply with a large number of legal regulations when receiving invoices. Software must support these regulations. In addition to HGB and UstG, the GoBD play a special role. Invoices must be documented, stored in an audit-proof manner for ten years, and protected against unlawful access. Corresponding rules should be firmly integrated in the P2P solutions. Audit-proof archiving of documents is also a must. For example, documents and associated historical data (e.g., changes, workflow releases) can be stored in an archive connected via SAP ArchiveLink.

Functionalities around the analysis of workflows are central to making the entire incoming invoice process transparent and optimizing it. Extensive statistics provide relevant KPIs such as throughput times, automatic processing rates or discount potential. The data plays an important role in reporting and controlling and also provides an important decision-making basis for future business processes.

800 invoices with MM and FI

The example of Schäfer Shop shows how the interaction between SAP and P2P add-on looks in practice. The B2B mail order company for office technology and furniture has relied on Easy Software solutions for electronic invoice processing in SAP for over fifteen years. The medium-sized company has to process around 200,000 incoming invoices per year. 80 percent of these are goods invoices with purchase order references, which are posted via SAP MM. The remaining cost invoices are processed via the financial accounting component of SAP FI. While the ERP system automatically assigns the majority of goods invoices to the correct purchase order, cost invoices usually require manual checking and approval.

The effort was enormous. Therefore, the provider decided to use Invoice Management for SAP Solutions. The goal was to automate the processes on a workflow basis and thus manage them smoothly. For this purpose, the solution from Easy Software combines all documents in a digital invoice receipt book and filters them according to criteria such as company code, invoice date, document type or status.

SAP workflows

In the workflow for goods invoices, the focus is on speed when processing price and quantity blocks. If, for example, there is a price difference between the purchase order and the invoice, the document is immediately forwarded to the responsible purchasing specialist. With the help of the Easy check workflow, in which around 130 employees are involved, causes can be determined in no time at all. This enables Schäfer to process around 60 percent of all incoming invoices automatically ("dark").

In the workflow for cost invoices, the person responsible for approval is automatically assigned to each invoice. The three-stage approval workflow can then be started at the click of a mouse. In a control table, the Easy software solution clearly and transparently shows who is allowed to sign off on amounts in a certain amount or only factually check invoices.

In unclear cases, the solution immediately informs the responsible specialist via e-mail or SAP Office inbox and requests invoice verification and approval. The individual invoices can be called up via a link, the pre-recorded data can be checked at a glance and, if necessary, supplemented, confirmed or rejected. Users can also add individual annotations and attachments such as proof of services, inspection reports or contracts via drag-and-drop. Defined escalation scenarios help prioritize the invoices to be checked and indicate when cash discount losses are imminent.

Schäfer Shop relies on Easy Archive for archiving. In the central storage, all archived documents are protected against changes and manipulation. All relevant system activities are automatically logged, data from the SAP system is effortlessly prepared and made available in accordance with a tax code.

If the combination of SAP system and software for invoice processing is successful, companies gain a clearly structured SAP workflow: transparent, easy to handle and efficient. Automated e-invoicing is often only the first step. This is because digitization achieves real added value across the entire purchase-to-pay process - from the requisition to the order and goods receipt to payment.