Germany is SAP Support World Champion

Internationalization and globalization are often cited drivers of change in the SAP environment. They change the requirements for the system landscape, influence its design and have an impact on operations.

As part of the market study "Corporate SAP Application Management", cbs Corporate Business Solutions surveyed industrial companies from the DACH region in the second half of 2014, evaluated 100 questionnaires and personally interviewed 25 IT/SAP decision-makers.

The focus was clearly on medium-sized and large companies. 67 percent of participants were at home in discrete manufacturing, 27 percent in process manufacturing. SMEs and large corporations with an annual turnover of more than 20 billion euros were not considered.

All participating companies have their headquarters in Germany and are represented internationally with at least five locations. Half (48 percent) even have more than 20 locations. Global presence unites the participants:

85 percent of the companies are represented with locations in all regions of the world (EMEA, Americas, APAC).

Typical global industrial companies

A global SAP ERP solution is the industry standard. For 87 percent of respondents, a global SAP ERP system is at the center of the system landscape.

A single-client system ("one-system/one-client") is the clearly preferred architecture model (83 percent). Only 13 percent do not describe their ERP system landscape as global.

However, the consolidation of the SAP system landscape is not complete: In addition to the global SAP ERP, there are a large number of SAP and non-SAP ERP systems.

Twelve percent of companies operate more than five SAP ERP systems. The vast majority (88 percent) either run a global ERP or currently operate up to five SAP ERP systems worldwide. These include a small number of multi-client systems (four percent).

Only selectively are expanded continental 3-ERP system lines (EMEA, Americas, Apac) or functionally tailored ERP system lines (e.g. Production, Sales & Service, Financials) being added. It is clear that the globalization of ERP systems is on its way, but not at the end.

Over two thirds of companies still also use non-SAP ERP systems. Companies do not only rely on SAP for ERP. In addition to SAP ERP, almost all companies (96 percent) use other business suite components.

This means that global ERP systems are generally operated as part of an extended SAP Business Suite system landscape. SAP BW is the most widespread, with one in five people using it (21 percent).

Almost as many use SAP GTS (16 percent) and SAP PI/PO (15 percent). Every tenth ERP user uses SAP CRM (10 percent). SAP HCM (7 percent) and SAP APO (6 percent) have a notable spread.

Central control is the motto: 92% of companies rely on a central IT organization. Two thirds (61%) have centrally managed IT at more than one location.

How big are IT departments? On average, 25 to 50 IT employees work in medium-sized companies and 100 in large companies. Overall, IT accounts for less than five percent of the total workforce.

Global SAP support - made in Germany

The ratios are also reflected in relation to the internal SAP support organization. 73 percent of respondents employ up to 25 internal SAP employees, 27 percent employ between 26 and 100 internal SAP employees.

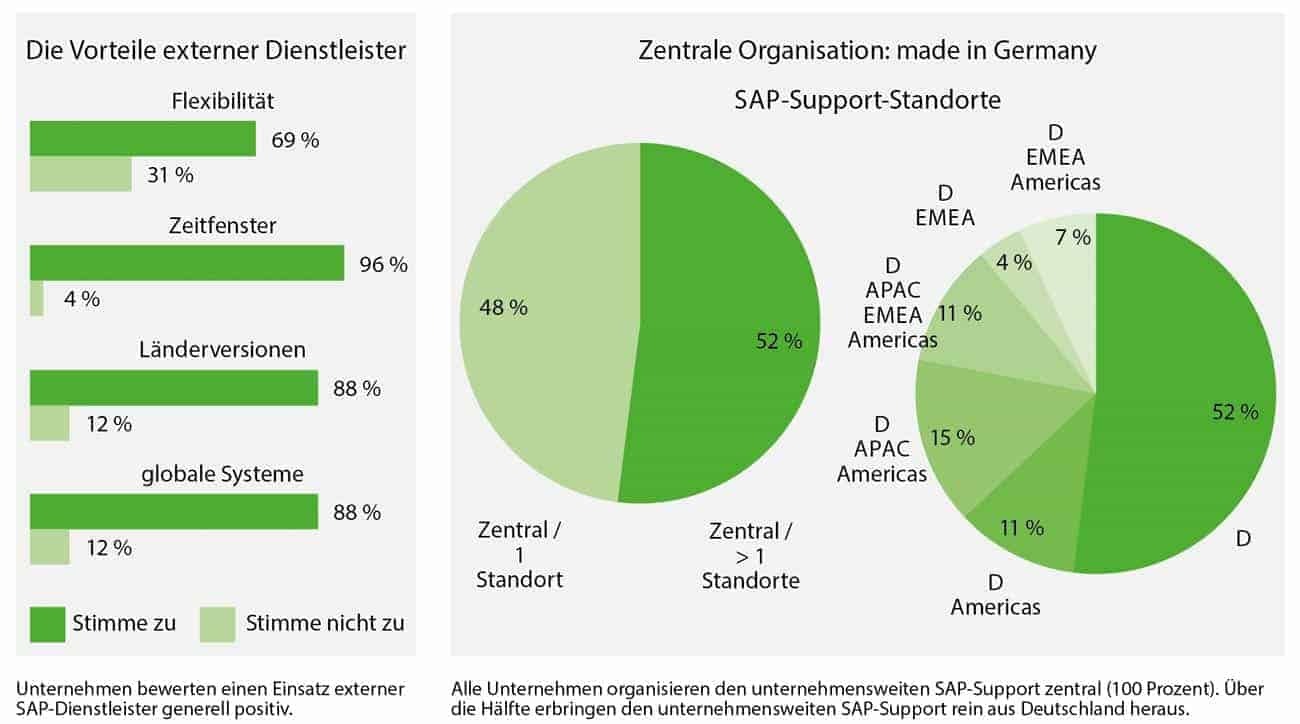

All of the companies surveyed also organize company-wide SAP support centrally (100 percent). A comparison is obvious: The manufacturing industry, an important pillar of the much-cited world export champion, also relies on quality "made in Germany" for the support of its global SAP operations.

Over 50 percent of companies provide company-wide SAP support purely from Germany. Depending on the international representation of the company, support is also provided from locations in other regions (EMEA, Americas, APAC).

However, global control sovereignty remains at headquarters. The support world champion also comes from Germany. Surprisingly, the participating companies seem to agree on the relevance of nearshore/offshore providers. In practice, they play either no role or no major role at all.

SAP employees as the girl for everything

SAP-related IT activities can be roughly categorized as planning (plan), building (build) and operating (run) the systems or applications. The logical distinction is theoretical.

In practice, there is no strict organizational separation according to plan/build/run. The following applies to all participating companies without exception: SAP employees are deployed across the board.

On average, project activities slightly outweigh operational tasks (40% build, 32.5% run); a maximum of 20% is used for planning tasks. The tasks of a typical SAP employee therefore include both project work and operational tasks.

IT budget: lion's share for SAP

IT budget: lion's share for SAP

For 82 percent of companies, the IT budget is between one and three percent of turnover. The majority of the IT budget is used for SAP. Half of the companies allocate between 30 and 50 percent of their IT budget to SAP.

At 15 percent, SAP expenditure is the highest IT budget item (greater than 50 percent). The proportion of the budget allocated to SAP application management varies greatly.

On the one hand, this is evidently due to cyclical differences in the focus of the individual companies' project and operating business, as well as the general bipolar basic orientation within the SAP support organizations, which are equally responsible for "build" and "run".

IT operating strategy

Hybrid strategies characterize IT operations. Three out of four companies outsource individual operational tasks to third parties. 19 percent operate their IT systems entirely on their own.

Eight percent of participants outsource operations completely, and the tasks that are outsourced to third parties are diverse. SAP accounts for a very high proportion of them.

System hosting in particular (18%) is outsourced. In the area of SAP projects (15 percent) and SAP application management (14 percent), companies also seek external support.

In the SAP environment, external support is the rule (85%). Only 15 percent of companies state that they manage without external support in the SAP environment.

Operating costs?

The extent to which SAP operating costs will change as a result of the globalization of application operation was not clearly stated by the SAP management of the companies surveyed. Overall, costs are expected to rise.

Only one in five anticipate a reduction in costs. 46 percent state that the costs per user are more likely to increase, while 31 percent see no significant change. SAP management is divided.

It is striking that only a minority (22%) believe that costs can be reduced in global SAP operations. The experience, possibilities and capabilities for cost optimization in the course of SAP globalization appear to be very different.

In addition to SAP ERP, almost all companies use other SAP components (96 percent). This increases operating costs overall. Individually, only selected solutions are the cause of significantly higher operating costs.

External services

Almost all companies use external employees. However, the form of deployment varies among the participants in the study. The participants were unanimous with regard to the support models.

The participants would like more flexibility. It should be possible to flexibly adapt the support to the prevailing requirements in projects and operations. The companies surveyed generally rate the use of external SAP service providers positively.

The use of specialists offers clear advantages, especially in the globalization environment. External third parties offer the greatest advantage when it comes to covering time windows (96%).

88% see the additional know-how for country-specific questions and requirements for global solution topics as the major added value of external service providers. For almost 70 percent, external service providers also offer a clear gain in flexibility.