Global e-invoicing - compliance, complexity, cost benefits

Companies face fines, some of them hefty, if they fail to transmit VAT or invoice data correctly to the electronic portals of a tax or revenue authority within a certain period of time. This puts companies under considerable pressure. Hungary, for example, imposes fines of 1,600 euros for each incorrectly transmitted invoice.

Nevertheless, reality also shows that governments often change their legal requirements for e-invoicing at very short notice and make improvements or even postpone them just a few days before they come into force.

In addition, the increasing legal requirements are also increasing the technical complexity of the e-invoicing systems used by companies.

The motivation behind these legal regulations is obvious: foreign governments are looking for new ways to enforce their tax laws.

The best way for them to do this is to require companies operating within their national borders to provide all invoices electronically. E-invoicing regulations are already in place in more than 60 countries worldwide, and this number is expected to continue to grow rapidly.

By 2010, the requirement for companies to send digitally signed invoices to the public sector was enforced across the board - thanks to EU Directive 2010/45. And as a result, business partners will also insist on electronic invoices to avoid the extra work involved in processing paper-based invoices.

So the future is clear: e-invoicing will become the standard not only for governments, but also for all business partners worldwide.

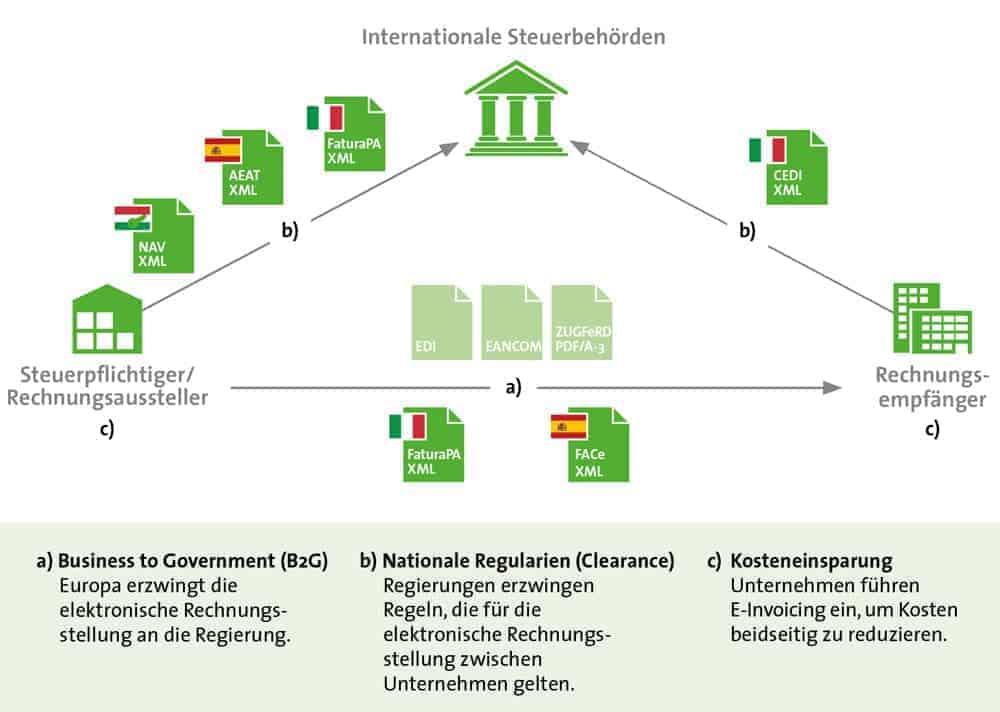

There are two types of e-invoicing regulations, commonly known as clearance and post-audit. For clearance schemes, regulating countries require that invoices to companies in their country are settled via an intermediary regulator.

These real-time controls typically include digital signatures. Post-audit, on the other hand, means that the country's regulations specify a minimum period over which electronic versions of invoices must be retained for possible automated review.

In and of itself, this sounds simple. Apart from the fact that within the two types, each of the numerous countries maintains its own nuances as to which data must be collected, how this data is collected, or different requirements are placed on the digital signature and more - internationally, e-invoicing in fact initiates a kind of reversal of the burden of proof: It is not the government that has to prove that a company is guilty, but the company that it is innocent.

Clearly, compliance is critical as global cross-border trade becomes the norm. Compliance would not be such a challenge if it were not for the many unique requirements around the world that add to the complexity.

Increasing complexity

There are three dimensions that contribute to the complexity of e-invoicing compliance: first, the speed at which regulations change. The other is the number of countries that require e-invoicing in some form. In addition, the various details of the regulation that each country applies also have an impact.

One of the biggest challenges in international business is keeping up with regulatory changes. Countries such as Hungary, Italy and Spain have already required e-invoicing compliance since July 1, 2018.

Italy is one of the pioneers in

Implementation of the e-invoicing EU Directive 2010/45. The exchange system "Sistema di Interscambio" (SdI) was already launched in March 2015. The so-called FatturaPA, which is also accepted by public administrations, was used as the electronic invoice format.

The FatturaPA is to be provided with a certified XAdES-BES signature. Otherwise, the SdI exchange system provides communication channels for automatic integration (such as web services and FTP) and a web interface for manual uploads. All FatturaPA invoices must be stored and archived in accordance with Italian law.

In 2015, 2.7 million B2G electronic invoices were already sent to public administrations. Since January 2017, SdI can also be used for electronic invoicing between business partners in the private sector (B2B).

Every quarter, around 5000 B2B invoices are exchanged electronically between business partners, although there is no obligation to use them.

With the adoption of the Italian Budget Law 2018, electronic invoicing between private companies became finally mandatory for domestic B2B and B2C invoices.

Since July 1, 2018, services provided by subcontractors in a supply chain of companies involved in contracts with a public administration must be reported via SdI.

Only the mandatory reporting of deliveries of gasoline or diesel for use as motor fuel has been postponed from July 1, 2018 to January 1, 2019. As of January 1, 2019, all invoices from Italian suppliers to Italian buyers must be submitted in FatturaPA format via the SdI exchange system.

Only then are the invoices considered issued from a tax point of view. Transmission to the invoice recipient is not carried out by the sender, but by the SdI exchange system.

Hungary introduced a similar procedure on July 1, 2018. The focus here is on the transmission of VAT-relevant data to the tax authority (also known as "Business to Tax" or B2T for short).

Accordingly, companies operating in Hungary (both Hungarian companies and foreign companies registered in Hungary for VAT purposes) must transmit the contents of their outgoing invoices directly electronically to the Hungarian tax authorities in NAV XML format.

This applies to all invoices with a VAT portion greater than HUF 100,000 (approx. EUR 300). The transmission must take place no later than the 15th day after delivery of the goods or provision of the service.

From an optional to a mandatory provision

You don't have to be a prophet: corresponding regulations as outlined above will increase significantly in the coming years. The obligation to transmit invoices electronically to public administrations (B2G) has been in place for a relatively long time, but is often still accompanied by wording such as "can be transmitted electronically" or is virtually subject to reservation.

This will soon change and become a mandatory requirement. In order to avoid a shadow economy, many countries will shift towards B2B clearance procedures - even in simplified form - as the standard.

Meeting legal requirements is one side of the coin. The other: the cost savings that can be achieved for companies compared to "paper invoice processes" - both in terms of incoming and outgoing invoices.

They range between 60 and 80 percent. Furthermore, e-invoicing increases the quality of invoice processing. In addition, more invoices can be processed in less time.

For companies operating in more than one e-invoicing country, there are two key challenges: Speed and scalability. Given the fast pace of the e-invoicing world, it is extremely important to be able to implement regulatory requirements quickly and accurately.

Equally important is the ability for an implementation to scale should a move to new countries be forthcoming. After all, you don't want to be prevented from doing new or additional business because of regulatory compliance.

To reduce implementation risk, many companies are opting for cloud-based e-invoicing services that increase both implementation speed and operational scalability.

Ideally, a cloud-based service for global e-invoicing offers the following: on the one hand, the option to start with one country. And on the basis of a pay-per-use pricing model.

On the other hand, one should meet the respective legal requirements for archiving and support all current necessities of the regulated countries.

On top of that, the cloud service should already take into account future compliance requirements and provide simple yet powerful tools to ensure the integration of data according to different needs.