No goods movement without e-invoicing

![[shutterstock.com:106288610, Leszek Glasner]](https://e3magpmp.greatsolution.dev/wp-content/uploads/2017/06/shutterstock_106288610.jpg)

Latin America is an important market for European companies. In recent years, Brazil has been the predestined target for the expansion of European companies as a growth engine.

In the meantime, other countries are also acting as magnets. Anyone who sets up a new plant or establishes a new sales company in this region usually also introduces SAP there.

In particular, companies that are now taking their first steps on this continent often run into massive problems that, in retrospect, could have been avoided.

This is because, with regard to tax payments and communication with the tax authorities, the legal requirements differ significantly from the European legal area.

This also has an impact on SAP implementation. The strict legal requirements go far beyond reporting obligations. Even more, they have a concrete impact on logistical processes and can cause massive disruptions to operations, thus affecting the profitability of the Latin American company.

This makes it all the more important for European industrial companies considering an SAP rollout to Latin America to raise awareness and sensitivity to the issue early on, so that the implementation and its long-term operation are a success.

LatAm

To understand why the requirements in Latin American countries are so specific, it is worth taking a look at the reasons for the introduction of electronic invoicing (e-invoicing).

Unlike in Europe, where "cost-saving" is often the driving force behind innovations such as e-invoicing, there are very different motives for their introduction in Latin America. Rampant tax evasion and a growing shadow economy, as well as the associated distrust of authorities toward economic actors, are the drivers for strict compliance requirements.

In the European region, e-invoicing is largely a business-to-business (B2B) process. Electronic invoices are exchanged between supplier and buyer.

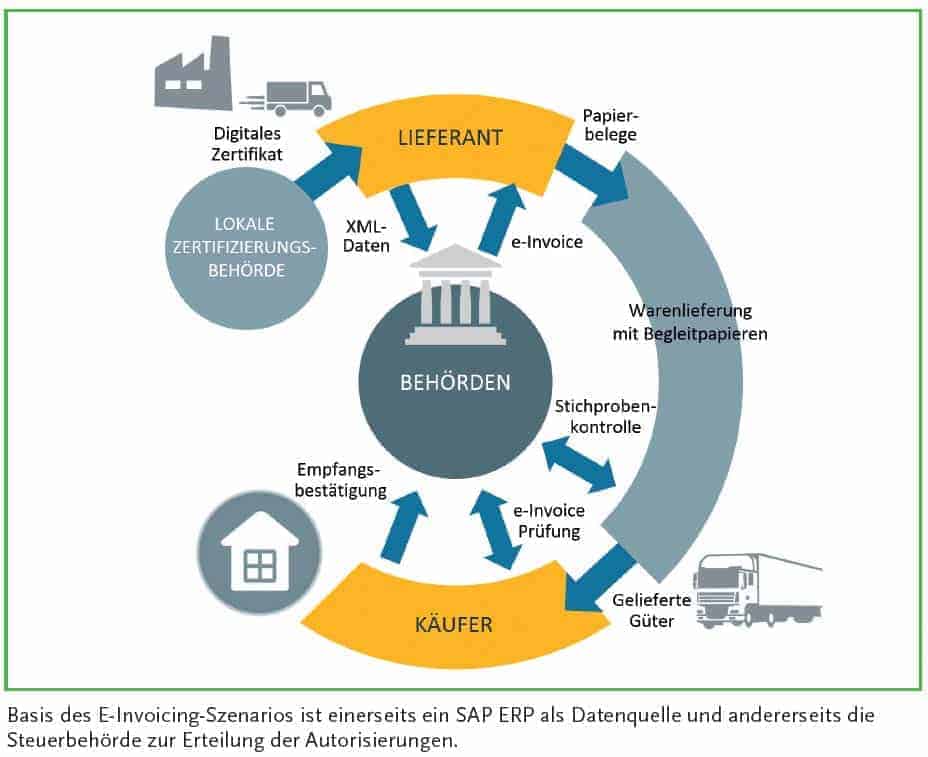

In Latin America, on the other hand, the tax authority is basically the recipient of the e-invoice. It is primarily a business-to-government (B2G) process.

However, the tax authority is not in a purely passive role here. On the contrary, an e-invoice, and thus also the associated business transaction, is only valid from a legal perspective if it is actively authorized by the authority.

To date, Latin American countries have been global pioneers when it comes to e-invoice volumes and innovations, so-called added values, such as automation processes.

With the introduction of mandatory e-invoicing, significant successes have been achieved in the fight against tax evasion. Mexico, for example, was able to increase its tax revenues by 34 percent in 2013, the year of introduction.

And the trend continues to point upward. It is therefore not surprising that in recent years almost all Latin American countries have introduced similar requirements or are in the process of rolling them out. For example, rollouts for B2G requirements are currently underway in Colombia, Peru and Uruguay.

Implementation

Three major challenges can be identified from the complex requirements for e-invoicing and their implementation in SAP:

Frequent legal changes

In 2016 alone, more than ten major changes to legal compliance requirements have been announced for Latin American countries that directly impact an SAP implementation.

On-site specialists are needed to check the impact on the local SAP implementation. If changes are necessary, expenses are incurred for implementation and regression testing.

Short periods of less than three months between the announcement of the requirement and the obligation to implement it, with sometimes massive effects in SAP (e.g. Support Package Upgrade), are not uncommon here.

Critical process

A prominent feature of compliance implementations in Latin America is the dovetailing of legal requirements with concrete logistical processes.

In most Latin American countries, for example, it is mandatory to have the e-invoice for a business transaction authorized by the authority before the goods are moved.

Goods cannot be moved without authorization. This applies even if a manufacturer only wants to move goods from A to B within his own company premises.

If the truck is then already in the yard and is not allowed to drive off due to a missing authorization, economic damage quickly occurs because supply chains may be interrupted and production lines may come to a standstill.

Support

The massive negative impact of unavailability and frequent legal changes require continuous implementation updates and proactive monitoring.

Due to the complexity of local requirements, trained personnel are absolutely essential. Providing this in a centralized support organization in Europe is time-consuming and cost-intensive.

Every company should ask itself whether it can guarantee seamless support with correspondingly short response times during Latin American business hours.

eDocument and Hana Cloud Integration

The basis of the e-invoicing scenario is, on the one hand, an SAP ERP as a data source and, on the other hand, the tax authority (or a service provider) for issuing authorizations.

In between, an integration platform such as SAP PI is usually required. For countries such as Brazil and Argentina, SAP offers solutions via the SAP PI integration platform.

For Mexico, SAP covers the requirements in the ERP, but does not provide an interface, so that a separate development, for example in SAP PI, is necessary.

SAP is taking a new approach with the compliance solutions for Chile and Peru. For these countries, the new globalization framework eDocument is used in the ERP and the authority notifications are carried out via Hana Cloud Integration (HCI).

The eDocument Framework is part of SAP ERP and contains all the building blocks needed in the backend for e-invoicing scenarios. It is modular to meet the flexibility for the different requirements of different countries and is the basis for future solutions of SAP e-invoicing scenarios.

Currently, six countries (including Chile and Peru) are supported - the mapping of additional countries has been announced. With this new approach, SAP delivers the interface as content for SAP HCI.

HCI is part of the Hana Cloud Platform (HCP) and offers a cloud alternative to the on-premise middleware SAP PI for ready-made scenarios. HCI in particular has not yet arrived in the SAP landscape of many companies.

However, those who rely on harmonized global solutions will not be able to avoid it in the future. The Heidelberg-based SAP consulting firm cbs Corporate Business Solutions is a proven South America specialist.

cbs has the expertise from more than 50 LatAm rollouts, including the necessary integration know-how with SAP PI and SAP HCI, to lead an e-invoicing rollout from planning to implementation to success.

On premise vs. cloud

Cloud solutions are on everyone's lips. SAP is also pushing ahead on all fronts with its further development into a cloud company. The aforementioned HCI is just one of many products in SAP's cloud portfolio.

For Latin American e-invoicing, cbs offers a hybrid cloud solution based on SAP software as SAP Partner Managed Cloud. This solution goes a step further than the usual Infrastructure-as-a-Service or Software-as-a-Service cloud products.

The cbs LatAm Cloud provides e-invoicing as a Process as a Service. This maximum approach to outsourcing the business process offers companies the greatest possible simplification and relief. This is because they do not need to maintain any specialist and technical knowledge in relation to Latin America.

The cbs LatAm Cloud is hosted in the German data center of the IT full-service provider Materna, the cbs parent company. This ensures data protection in accordance with German law.

In addition to infrastructure operation in an ITIL-compliant, TÜV and ISO27001-certified data center, the cloud service also includes managed services for basic operation, such as monitoring, alerting, security and performance adjustment.

Conclusion

Latin America is one of the countries with the most complex legal and tax requirements in the world. These have such a profound effect on logistics processes that technical errors in SAP ERP and the interfaces can quickly lead to blocked supply chains, production downtime and thus economic damage.

In addition, legal requirements are constantly changing, so that adjustments to the SAP system are required on an ongoing basis. For a successful SAP rollout with an e-invoicing implementation that creates long-term added value, the right course must therefore be set early on.

Whether cloud or on premise, whether SAP PI or SAP HCI, whether central support or outsourcing - these are all important decisions that depend on many factors and must be evaluated in detail for each company individually.